Posts Tagged: Malaysia

How To Choose The Best SEO Service In Malaysia For Your Business

Are you searching for the best SEO service in Malaysia to boost your business? Look no further! In this article, we will guide you through the process of choosing the perfect SEO service provider for your specific needs. Whether you’re a small startup or a well-established company, we understand the importance of reaching your target audience and improving your online presence. With our friendly and comprehensive approach, we’ll walk you through the steps so you can make an informed decision and take your business to new heights. Let’s get started!

Choosing the Right SEO Service in Malaysia

Are you a business owner in Malaysia looking to improve your online visibility and attract more customers? If so, choosing the right SEO service is essential. Search Engine Optimization (SEO) plays a crucial role in driving organic web traffic, increasing brand awareness, and ultimately, boosting sales. With so many SEO service providers available in the market, it can be overwhelming to make the right choice. But fear not, this comprehensive article will guide you through the process of selecting the best SEO service in Malaysia for your business.

Understanding the Importance of SEO for Your Business

Before diving into the process of selecting an SEO service provider, let’s first understand the importance of SEO for your business. SEO is the practice of optimizing your website to rank higher in search engine results pages (SERPs). By improving your website’s visibility, you can attract more organic (unpaid) traffic and increase your chances of converting visitors into customers.

The basics of SEO involve various strategies and techniques such as keyword research, on-page optimization, link building, and content creation. A well-executed SEO strategy can bring numerous benefits to your business, including increased website traffic, improved brand visibility, enhanced user experience, and higher search engine rankings.

Determining Your SEO Goals and Objectives

Before embarking on your search for an SEO service provider, it’s crucial to determine your SEO goals and objectives. Identifying what you want to achieve through SEO will help you find the right service provider who aligns with your business needs.

Start by identifying your target audience and market. Understanding who your potential customers are and where they are located will give you insights into the SEO strategies required to reach them effectively.

Next, define your Key Performance Indicators (KPIs). These are measurable metrics that will help gauge the success of your SEO efforts. Whether it’s increasing website traffic, improving search engine rankings, or generating more leads, establishing clear KPIs will allow you to track progress and evaluate the effectiveness of the SEO service provider.

Lastly, set realistic SEO goals for your business. Ensure that your goals are attainable within a reasonable timeframe and align with your overall business objectives. Clear goals will also provide a benchmark for evaluating the performance of the SEO service provider.

Researching and Shortlisting SEO Service Providers

With your SEO goals in mind, it’s time to conduct thorough research and shortlist potential SEO service providers. Start by performing an online search, focusing on companies that specialize in SEO services and have a strong presence in Malaysia. You can use search engines, business directories, and industry-specific websites to find potential candidates.

Reading reviews and testimonials is an excellent way to gauge the reputation and credibility of SEO service providers. Look for feedback from their previous clients to get insights into their service quality, customer satisfaction, and results achieved. Positive reviews and testimonials can instill confidence in their ability to deliver effective SEO solutions for your business.

Furthermore, check for accreditations and certifications. A reputable SEO service provider should have certifications from recognized organizations such as Google, Bing, or SEMrush. These certifications validate their expertise and commitment to staying updated with the latest SEO practices.

Assessing the Reputation and Experience of SEO Service Providers

Once you have shortlisted a few SEO service providers, it’s essential to assess their reputation and experience. Start by evaluating their website and online presence. A professionally designed and optimized website indicates their knowledge and expertise in the field. Look for case studies, client success stories, and industry awards that can further establish their credibility.

Client testimonials play a vital role in determining the trustworthiness of SEO service providers. Reach out to their past or existing clients if possible to gather more information about their experiences. A reliable SEO service provider will have a proven track record of delivering results and building long-term relationships with clients.

Analyzing the SEO Service Provider’s Track Record and Case Studies

To gain deeper insights into the performance of SEO service providers, it’s crucial to evaluate their track record and case studies. Assess their past projects and results to determine if they have experience in your industry or niche. A service provider with relevant experience will have a better understanding of your business needs and can tailor their strategies accordingly.

Verifying the authenticity of case studies is critical. Look for tangible results achieved by the SEO service provider, such as improved search rankings, increased organic traffic, or higher conversion rates. Ideally, seek case studies that showcase long-term success to ensure the service provider consistently delivers results.

Furthermore, consider the longevity of their client relationships. A service provider with long-term clients suggests their ability to maintain client satisfaction and provide ongoing support. Long-lasting partnerships indicate a high level of trust and reliability.

Considering the Range of SEO Services Offered

The range of SEO services offered by a service provider is another crucial factor to consider. An effective SEO strategy encompasses various aspects, including on-page optimization, off-page SEO strategies, technical SEO capabilities, and local SEO expertise.

On-page SEO optimization focuses on optimizing individual web pages to improve their search engine rankings. It involves optimizing meta tags, headings, content, and URL structure. Be sure to choose a service provider that excels in this area to ensure your website performs well in search engine results.

Off-page SEO strategies involve building high-quality backlinks and enhancing your website’s online reputation. A reliable SEO service provider will have effective strategies for acquiring backlinks from reputable websites, which can improve your website’s authority and visibility.

Technical SEO capabilities are crucial for ensuring your website is crawlable and accessible by search engine bots. This includes optimizing website speed, mobile-friendliness, and site architecture. Choose an SEO service provider that has expertise in technical SEO to improve your website’s overall performance.

Local SEO expertise is especially important for businesses targeting a specific geographical area. The service provider should be knowledgeable in optimizing your website for local search results, including Google My Business optimization, local citations, and customer reviews.

Evaluating the Expertise and Skill Set of the SEO Team

The expertise and skill set of the SEO team working for the service provider should not be overlooked. A competent SEO team will have the knowledge and experience to implement effective strategies that align with your business goals.

Understand the qualifications and background of the SEO team. Look for team members with relevant certifications and training from reputable organizations in the field of SEO. This ensures they possess the necessary skills and expertise to handle your SEO needs.

Additionally, assess their experience with similar businesses or industries. An SEO team with experience in your particular niche will have a better understanding of the challenges and opportunities your business faces. Their industry knowledge can result in more tailored and effective SEO strategies.

Examining the SEO Service Provider’s Communication and Reporting

Effective communication and transparent reporting are vital for a successful partnership with an SEO service provider. Evaluate the communication channels they offer and their response time. Choose a provider that offers regular updates and prompt communication to address any concerns or questions you may have.

Understanding the SEO reporting structure and frequency is crucial. The service provider should provide comprehensive reports that outline the progress of your SEO campaigns and the results achieved. Clear and transparent reporting allows you to track the effectiveness of their strategies and make informed decisions.

Determine the availability of account managers. Having a dedicated account manager can ensure personalized attention to your needs and prompt resolution of any issues that may arise. The account manager acts as the point of contact between you and the SEO service provider, facilitating effective communication and collaboration.

Reviewing the Pricing and Contract Terms

When considering SEO service providers, reviewing the pricing and contract terms is essential. Request detailed pricing information from the shortlisted providers and compare them to ensure you are getting value for your investment. Be cautious of extremely low-priced services, as they may indicate a lack of expertise or a shortcut approach that could harm your website’s search engine rankings.

Carefully review the contract terms before making a decision. Understand the duration of the contract, cancellation policies, and any additional costs or hidden fees. A reputable SEO service provider will be transparent about their pricing structure and contract terms, ensuring you can make an informed decision.

Seeking Recommendations and Referrals

Lastly, seeking recommendations and referrals can provide valuable insights when choosing an SEO service provider. Ask for referrals from trusted sources such as friends, business associates, or industry peers who have experience with SEO services. Their firsthand recommendations can help you identify reliable providers and narrow down your choices.

Additionally, consult online SEO communities and forums to gather more information about SEO service providers in Malaysia. These communities are a great resource for insights, feedback, and experiences shared by SEO professionals and businesses alike. Engaging in discussions can help you gain a better understanding of the reputable SEO service providers in the market.

By following these guidelines and thoroughly evaluating potential SEO service providers, you can make an informed decision that aligns with your business goals. Remember, selecting the right SEO service provider is an investment in the growth and success of your business in the digital landscape.

A Comprehensive Guide to Home Financing Options in Malaysia

Looking to buy a home in Malaysia but feeling overwhelmed by the plethora of financing options available? Don’t worry, we’ve got you covered! In this comprehensive guide, we’ll walk you through the various home financing options in Malaysia, providing you with all the information you need to make an informed decision. From H1 tags to H3 tags, each article is carefully structured to ensure easy navigation and understanding. With a minimum of 2500 words per article, we delve into the world of home financing in a friendly and approachable tone, making it a breeze for you to explore further. So grab a cup of tea, sit back, and let’s dive into the exciting world of home financing options in Malaysia!

A Comprehensive Guide to Home Financing Options in Malaysia

Buying a home is an exciting milestone in your life, but it can also be a complex and overwhelming process. One of the most crucial aspects of purchasing a property is securing the right home financing option. With so many choices available in Malaysia, it’s essential to have a clear understanding of the various home financing options before making your decision. In this comprehensive guide, we will explore the different types of home loans and financing schemes available to help you make an informed choice.

1. Conventional Home Loans

1.1 Overview of Conventional Home Loans

Conventional home loans are the most common type of financing option in Malaysia. They are offered by banks and financial institutions and are governed by the standard lending practices. Conventional home loans are not linked to any specific religious or cultural requirements and are suitable for individuals of all backgrounds.

1.2 Features and Benefits

Conventional home loans come with several features and benefits that make them a popular choice among homebuyers. These include flexible repayment options, competitive interest rates, and the ability to prepay the loan without incurring any penalties. Additionally, conventional home loans can be used to finance all types of residential properties, such as landed houses, apartments, and condominiums.

1.3 Eligibility Criteria

To be eligible for a conventional home loan, you generally need to meet certain criteria set by the lending institution. This includes having a stable source of income, a satisfactory credit history, and a reasonable debt-to-income ratio. The specific eligibility criteria may vary between lenders, so it’s important to check with the chosen institution to ensure you meet their requirements.

1.4 Application Process

When applying for a conventional home loan, you will typically need to provide the lender with various documents, such as proof of identity, income statements, and property details. The application process may involve a thorough assessment of your financial situation, creditworthiness, and the property you intend to purchase. It’s essential to gather all the necessary documents and submit them accurately to expedite the loan approval process.

1.5 Pros and Cons

Like any other financing option, conventional home loans have their advantages and disadvantages. Some of the pros include the flexibility to choose from a wide range of lenders, competitive interest rates, and the potential for higher loan amounts. However, one of the downsides of conventional home loans is that they do not cater to individuals with specific religious requirements. Additionally, the approval process may involve strict eligibility criteria and a longer time frame compared to other financing options.

2. Islamic Home Financing

2.1 Introduction to Islamic Home Financing

Islamic home financing, also known as Shariah-compliant financing, is a type of home loan that adheres to the principles of Islamic finance. It caters to individuals who prefer financing options that align with their religious beliefs. Islamic home financing operates on the concept of profit and risk-sharing, rather than interest-based lending.

2.2 Principles of Islamic Financing

Islamic home financing is guided by principles outlined in Islamic law, known as Shariah. The key principles include the prohibition of charging or receiving interest (riba), the avoidance of uncertainty (gharar), and the prohibition of investment in unethical activities (haram). Instead, Islamic home financing utilizes concepts such as profit-sharing (mudarabah), cost-plus financing (murabahah), and leasing (ijara) to facilitate the purchase of a property.

2.3 Types of Islamic Home Financing

There are different types of Islamic home financing options available in Malaysia, each with its own unique features. Some popular options include Musharakah Mutanaqisah, Ijarah Muntahiyah Bittamlik, and Bay’ Bithaman Ajil. These options offer variations in terms of profit-sharing, ownership structure, and payment methods, allowing borrowers to choose an option that best suits their needs.

2.4 Eligibility and Documentation

The eligibility criteria and documentation requirements for Islamic home financing are similar to conventional home loans. Borrowers need to have a stable income, good credit history, and meet the lender’s specific requirements. In addition, Islamic home financing may require additional documentation related to the specific Islamic finance principles being applied.

2.5 Comparison with Conventional Home Loans

Islamic home financing differs from conventional home loans primarily in the way the loans are structured and the principles they abide by. While conventional home loans charge interest, Islamic home financing uses alternative methods such as profit-sharing or cost-plus financing. Additionally, Islamic home financing caters to individuals with specific religious requirements, providing an alternative for those who want to ensure adherence to Islamic principles.

3. Fixed-Rate Home Loans

3.1 Basics of Fixed-Rate Home Loans

Fixed-rate home loans are a popular choice for individuals seeking stability and predictability in their loan repayments. With a fixed-rate loan, the interest rate remains constant throughout the loan tenure, allowing borrowers to plan their finances with confidence. This is in contrast to variable-rate loans, where the interest rate can fluctuate over time.

3.2 Advantages and Disadvantages

One of the advantages of a fixed-rate home loan is that it provides borrowers with a consistent repayment amount, making it easier to budget and manage finances. It also offers protection against potential interest rate hikes, as borrowers are not affected by market fluctuations. However, the downside of fixed-rate home loans is that they typically come with higher interest rates compared to variable-rate loans. Additionally, borrowers may miss out on potential savings if interest rates decrease during the loan tenure.

3.3 Choosing the Right Terms and Tenure

When opting for a fixed-rate home loan, it’s crucial to carefully consider the loan terms and tenure. The loan term refers to the duration over which the loan will be repaid, while the loan tenure determines the number of years it will take to fully repay the loan. It’s important to strike a balance between a shorter loan term, which may result in higher monthly repayments, and a longer loan term, which may result in higher overall interest payments.

3.4 Application Process

The application process for a fixed-rate home loan is similar to other home loans. Borrowers need to provide the necessary documentation, such as proof of identity, income statements, and property details. Lenders will assess the borrower’s eligibility based on factors such as creditworthiness, debt-to-income ratio, and employment stability. Once approved, the loan agreement will outline the fixed interest rate, loan terms, and repayment schedule.

3.5 Understanding the Loan Repayment

With a fixed-rate home loan, the repayment amount remains consistent throughout the loan tenure. Borrowers make regular monthly payments that include both the principal amount and the fixed interest rate. By understanding the loan repayment structure, borrowers can effectively plan their finances and ensure timely repayment to avoid any penalties or defaults.

4. Variable-Rate Home Loans

4.1 Introduction to Variable-Rate Home Loans

Variable-rate home loans, also known as adjustable-rate mortgages, are loans with interest rates that can change over time. Unlike fixed-rate loans, where the interest rate is locked in for the entire loan tenure, variable-rate loans are subject to market fluctuations and adjustments based on economic factors.

4.2 How the Interest Rates are Determined

The interest rates for variable-rate home loans are typically tied to a benchmark rate, such as the Base Rate (BR) or the Islamic Financing Rate (IFR), set by the respective financial institution. The benchmark rate is influenced by factors such as economic conditions, inflation, and monetary policy. When the benchmark rate changes, the interest rate on the variable-rate home loan will adjust accordingly.

4.3 Pros and Cons

Variable-rate home loans offer several advantages. Initially, the interest rates are typically lower compared to fixed-rate loans, allowing borrowers to enjoy lower monthly repayments. Additionally, if interest rates decrease over time, borrowers may benefit from reduced repayment amounts. However, one of the drawbacks of variable-rate loans is the uncertainty associated with fluctuating interest rates. Borrowers need to be prepared for the possibility of higher repayment amounts if interest rates rise.

4.4 Factors to Consider Before Opting for Variable Rates

Before considering a variable-rate home loan, it’s important to assess your risk tolerance and financial capability to handle potential interest rate fluctuations. Borrowers should analyze market conditions, economic forecasts, and consult with financial advisors to make an informed decision. Understanding the potential impact of interest rate changes on your monthly budget and overall financing can help mitigate any future financial strain.

4.5 Risks and Rewards

Variable-rate home loans carry inherent risks and rewards. The reward lies in the potential for lower initial interest rates and the possibility of saving money if interest rates decrease. However, there is also the risk of higher interest rates, leading to increased monthly repayments. Borrowers need to carefully weigh the risks and rewards, considering their financial goals and the long-term impact of possible interest rate fluctuations on their overall repayment strategy.

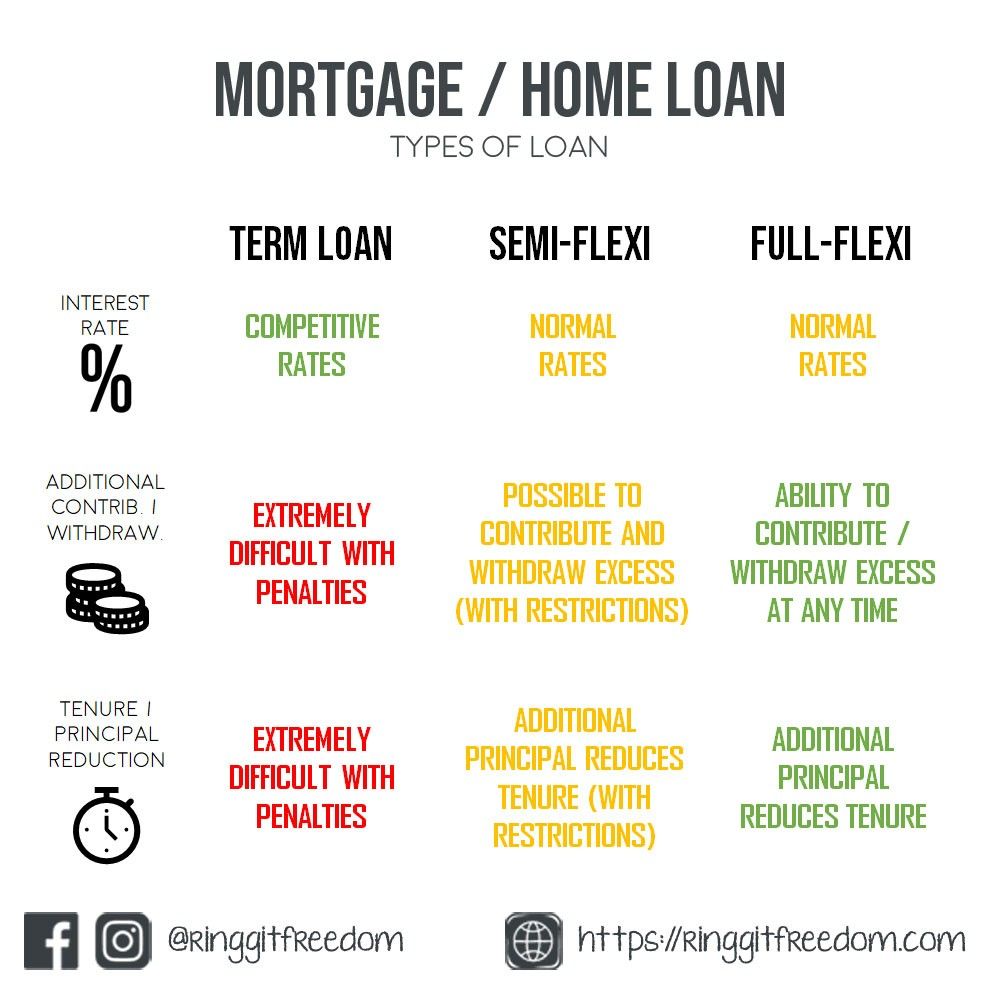

5. Flexi Home Loans

5.1 Understanding Flexi Home Loans

Flexi home loans, also known as flexible home loans, offer borrowers greater control and flexibility over their loan repayments. These loans are designed to provide more options and features that cater to individual financial needs and circumstances.

5.2 Benefits and Features

Flexi home loans offer various benefits and features that make them an attractive option for borrowers. Some of these benefits include the option to make extra repayments, withdraw excess payments, and the potential to reduce the overall interest paid. Flexi home loans also allow borrowers to make changes to their repayment schedules, such as adjusting the loan tenure or taking repayment breaks during emergencies.

5.3 How It Works

Flexi home loans operate on the concept of an overdraft facility linked to the borrower’s home loan account. Any excess funds deposited into the account can be used to offset the outstanding loan amount, effectively reducing the loan tenure and overall interest paid. Borrowers can also withdraw the excess funds if needed, providing a safety net during financial emergencies.

5.4 Eligibility and Considerations

The eligibility criteria for flexi home loans are similar to other home loan options. Borrowers need to meet the lender’s requirements in terms of income, credit history, and property details. It is important to consider factors such as the annual fee, late payment charges, and minimum balance requirements associated with the flexi home loan facility. It’s also essential to evaluate your financial capability to take advantage of the flexibility offered by this loan option effectively.

5.5 Repayment Options and Strategies

With flexi home loans, borrowers have the flexibility to choose from different repayment options and strategies. They can opt for regular monthly repayments or make extra repayments whenever they have surplus funds. The extra repayments can help offset the loan principal and reduce the overall interest paid. Borrowers can also take advantage of features like the redeposit facility, which allows any withdrawn excess funds to be redeposited into the loan account, further reducing the interest payable.

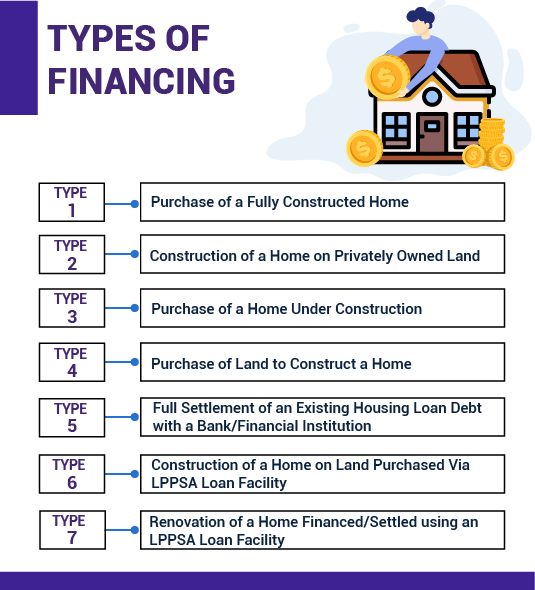

6. Government Home Financing Schemes

6.1 My First Home Scheme

The My First Home Scheme is a government initiative aimed at assisting first-time homebuyers in Malaysia. It is designed to make homeownership more accessible to young individuals or families who have yet to own a property. The scheme offers various benefits such as financing up to 100% of the property value, preferential interest rates, and longer loan tenures.

6.2 PR1MA Home Financing

PR1MA Home Financing is a government initiative managed by PR1MA, the 1Malaysia People’s Housing Programme. The program provides affordable housing options for middle-income individuals and families in Malaysia. PR1MA Home Financing offers attractive financing packages, including high loan-to-value ratios, competitive interest rates, and flexible repayment options.

6.3 First Home Deposit Funding Scheme (MyDeposit)

The First Home Deposit Funding Scheme, also known as MyDeposit, is an initiative aimed at assisting first-time homebuyers in saving for the deposit required to purchase a property. Under the scheme, eligible individuals can receive financial assistance in the form of a 10% deposit, up to a maximum of RM30,000. MyDeposit helps bridge the affordability gap and makes homeownership more attainable for aspiring homeowners.

6.4 Skim Rumah Pertamaku

Skim Rumah Pertamaku, or My First Home Scheme (SRP), is another initiative introduced by the government to assist first-time homebuyers. The scheme offers various incentives and benefits, including higher loan limits, lower interest rates, and partial stamp duty exemptions. The SRP aims to encourage homeownership among first-time buyers and provide them with the necessary financial support to enter the property market.

6.5 Other Government Initiatives

In addition to the aforementioned schemes, there are other government initiatives aimed at promoting homeownership and providing affordable housing options. These include programs such as Rumah Selangorku, Program Perumahan Rakyat, and various state-sponsored affordable housing schemes. Each program has its own eligibility criteria, benefits, and guidelines, catering to different segments of the population based on income levels and geographical locations.

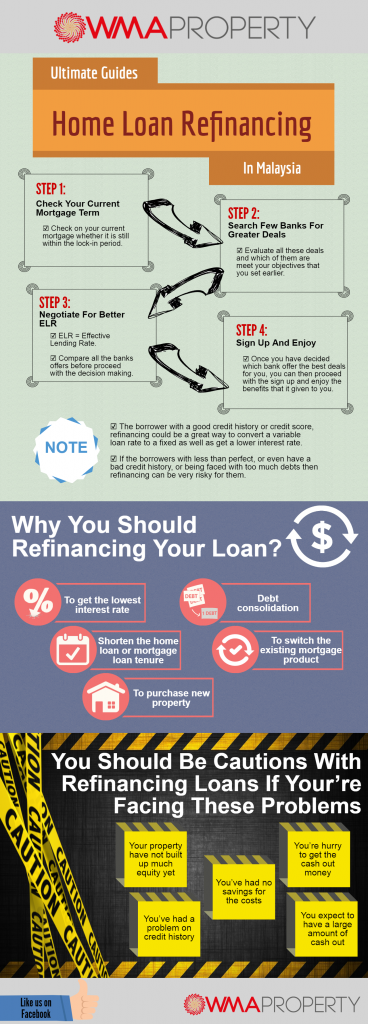

7. Home Loan Refinancing

7.1 Reasons for Refinancing

Home loan refinancing refers to the process of replacing an existing home loan with a new loan from another lender. There are several reasons why borrowers choose to refinance their home loans. These include obtaining a better interest rate, reducing monthly repayments, consolidating debts, accessing additional funds for home improvements, or changing loan tenure to better suit their financial goals.

7.2 When to Refinance

Deciding when to refinance your home loan depends on various factors, such as prevailing interest rates, your financial situation, and the costs associated with refinancing. It’s essential to assess whether refinancing will result in significant savings or benefits that outweigh the costs involved. Refinancing at the right time can potentially help you secure better loan terms and optimize your overall financial position.

7.3 Benefits and Drawbacks

Refinancing a home loan can offer several benefits, including the potential for lower interest rates, reduced monthly repayments, and access to additional funds. It can also help consolidate debts and improve your overall financial management. However, there are also drawbacks to consider, such as upfront costs, potential penalties for early loan repayment, and the impact on your credit score. It’s important to weigh these factors before deciding to refinance.

7.4 The Refinancing Process

The refinancing process involves several steps, including researching and comparing different lenders, gathering the necessary documentation, submitting an application, and undergoing a credit assessment. If approved, the new lender will pay off your existing loan, and you will start making repayments to the new lender under the new loan terms. It’s essential to carefully review the new loan agreement and understand the terms and conditions before finalizing the refinancing process.

7.5 Tips for Successful Refinancing

To ensure a successful refinancing experience, it’s important to follow a few tips. Start by conducting thorough research and comparing various lenders to find the most favorable terms and conditions. Prepare all the necessary documents in advance to streamline the application process. Assess your financial situation and goals to determine if refinancing aligns with your needs. Finally, consult with a financial advisor to fully understand the implications of refinancing and make an informed decision.

8. Home Equity Financing

8.1 Understanding Home Equity

Home equity refers to the portion of your property value that you own outright. It is the difference between the market value of your property and the outstanding amount of your home loan. Home equity increases as you make mortgage repayments and with any appreciation in property value.

8.2 Home Equity Loan vs. Home Equity Line of Credit

Home equity financing, also known as a home equity loan or a home equity line of credit (HELOC), allows homeowners to borrow against the equity in their property. A home equity loan provides a lump sum amount with fixed repayments, while a HELOC offers a revolving line of credit that can be drawn from as needed. Homeowners can choose the option that best suits their financial needs and goals.

8.3 Uses of Home Equity Financing

Home equity financing can be used for various purposes, including home improvements, debt consolidation, education expenses, or emergency funds. The funds obtained through home equity financing can provide homeowners with the flexibility and convenience to access cash when needed, often at lower interest rates compared to other forms of borrowing.

8.4 Eligibility and Application Process

To be eligible for home equity financing, homeowners typically need to have a minimum level of equity built up in their property. Lenders may have specific requirements regarding loan-to-value ratios and creditworthiness. The application process involves submitting the necessary documentation, undergoing a credit assessment, and having the property independently valued to determine the available equity.

8.5 Considerations and Risks

Home equity financing carries certain considerations and risks. Borrowing against your home equity means using your property as collateral, putting it at risk in case of default. It’s crucial to carefully consider the purpose and necessity of borrowing against your home equity and ensure that the repayment terms are manageable within your financial means. Additionally, fluctuations in property value can impact the available equity and borrowing capacity.

9. Bridging Loans

9.1 Overview of Bridging Loans

Bridging loans are short-term financing options designed to help borrowers bridge the financial gap between the purchase of a new property and the sale of their existing property. These loans provide temporary funding to cover the down payment or purchase price of the new property until the proceeds from the sale are received.

9.2 When to Use Bridging Loans

Bridging loans are typically used in situations where the timing of property transactions does not align. For example, if you have found your dream home but have not yet sold your current property, a bridging loan can provide the necessary funds to secure the new property while you wait for the sale proceeds.

9.3 How Bridging Loans Work

Bridging loans work by providing borrowers with short-term financing in the form of a loan secured against the property being purchased. The loan is typically repaid when the proceeds from the sale of the existing property are received. Bridging loans can be structured with several repayment options, such as monthly interest payments or deferred repayment until the sale is finalized.

9.4 Eligibility Criteria

Eligibility for bridging loans is generally based on the value of the existing property, the loan-to-value ratio, and the borrower’s ability to repay the loan. Lenders will also consider factors such as the expected sale price and timeline of the existing property sale. It’s important to note that bridging loans typically have higher interest rates and additional fees compared to traditional home loans.

9.5 Repayment and Risks

Repayment of a bridging loan occurs once the proceeds from the sale of the existing property are received. The loan terms will specify the repayment structure, which may include the payment of interest only during the bridging period or the accumulation of interest that is repaid at the end of the loan term. It’s important to carefully consider the risks associated with bridging loans, such as changes in property market conditions or delays in the sale of the existing property.

10. Construction Loans

10.1 Introduction to Construction Loans

Construction loans are specifically designed to finance the construction or renovation of a property. These loans provide funds in stages to cover the costs associated with the different phases of the construction project. Construction loans are temporary in nature and are generally converted to long-term financing, such as a conventional home loan, once the construction is completed.

10.2 Process and Stages of Construction Loans

Construction loans typically involve a phased release of funds based on the construction progress. The loan disbursement is structured in stages, such as land purchase, foundation, roof completion, and final completion. Each stage requires verification and inspection by the lender to ensure that the construction is progressing as planned. The funds are released to the borrower or directly to the contractor based on the completion of each stage.

10.3 Loan Disbursement Methods

The disbursement of funds in construction loans can be managed in different ways. One method involves the lender directly making payments to the contractor or suppliers based on invoices and receipts. Another method, known as the reimbursement method, requires the borrower to make the payments and submit reimbursement requests to the lender for approved amounts. The chosen method will depend on the agreement between the lender, borrower, and contractor.

10.4 Eligibility and Documentation

Eligibility for construction loans is based on factors such as the borrower’s financial capability, creditworthiness, and the feasibility of the construction project. Lenders will typically require a detailed construction plan, cost estimates, and the necessary permits or approvals. Providing accurate and comprehensive documentation is essential to facilitate the loan approval process and ensure smooth disbursement of funds.

10.5 Managing Construction Loan Risks

Construction loans come with inherent risks that borrowers need to be aware of. These risks can include cost overruns, delays in construction, or failure to complete the project. It’s important to work with reputable contractors, obtain all necessary permits, and have contingency plans to address any unforeseen challenges. Regular communication with the lender and proactive management of the construction project can help mitigate risks and ensure a successful outcome.

In conclusion, choosing the right home financing option is a crucial decision that can impact your financial well-being for years to come. It’s important to explore and understand the various options available in Malaysia, considering factors such as your financial situation, long-term goals, and specific requirements. By being well-informed and seeking professional advice when needed, you can navigate the home financing landscape with confidence and make an informed decision that suits your needs and aspirations.

The Ultimate Guide to Choosing the Top Vacuum Cleaner in Malaysia

Looking for the perfect vacuum cleaner in Malaysia? Look no further! In this ultimate guide, we’ll walk you through everything you need to know to make an informed decision. From understanding the different types of vacuum cleaners to helpful tips on what features to prioritize, we’ve got you covered. With proper headings, engaging content, and visual aids like videos and images, this friendly article aims to captivate your interest and provide you with all the information you need to choose the top vacuum cleaner for your needs in Malaysia. Say goodbye to dust and dirt, and say hello to a cleaner home!

Factors to Consider Before Buying a Vacuum Cleaner

When it comes to buying a vacuum cleaner, there are several factors you should consider to ensure you make the right choice for your cleaning needs. From the type of vacuum cleaner to the accessories and attachments, each element can have a significant impact on performance and functionality. By understanding these factors, you’ll be able to make an informed decision and find the perfect vacuum cleaner for your home or office. Let’s dive into each factor in detail.

Type of Vacuum Cleaner

The first factor to consider is the type of vacuum cleaner that best suits your needs. There are several types to choose from, each with its own strengths and weaknesses. Here are the most common types of vacuum cleaners you’ll come across:

Upright Vacuum Cleaners

Upright vacuum cleaners are the classic choice for many households. They are versatile and typically feature a rotating brush roll for effective carpet cleaning. With their upright design, they are easy to maneuver and offer excellent suction power.

Canister Vacuum Cleaners

Canister vacuums consist of a separate canister unit connected to a wand and cleaning head by a hose. They are known for their versatility and maneuverability, making them great for cleaning tight spaces and stairs. Canister vacuums often offer powerful suction and come with a variety of attachments for different cleaning tasks.

Stick Vacuum Cleaners

Stick vacuum cleaners are lightweight and slender, making them perfect for quick and easy cleaning. They are ideal for smaller spaces and surface cleaning, but may not have the same level of suction power as upright or canister vacuums.

Robot Vacuum Cleaners

Robot vacuum cleaners are the ultimate hands-free cleaning solution. They can navigate around your home autonomously, cleaning various surfaces such as carpets and hard floors. Robot vacuums are perfect for busy individuals who want to maintain a clean home without putting in too much effort.

Handheld Vacuum Cleaners

Handheld vacuum cleaners are compact and portable, making them excellent for cleaning small messes or reaching tight spaces. They are perfect for quick clean-ups and spot cleaning.

Convertible Vacuum Cleaners

Convertible vacuum cleaners offer the flexibility to convert between different configurations. For example, they can be used as both an upright and a canister vacuum. This versatility allows you to adapt the vacuum cleaner to different cleaning tasks and spaces.

Before purchasing a vacuum cleaner, consider the type that will best suit your cleaning needs. Think about the size of your home, the type of flooring you have, and the specific cleaning tasks you’ll be performing.

Suction Power

Another crucial factor to consider is the suction power of the vacuum cleaner. Suction power determines how effectively the vacuum can pick up dirt, debris, and pet hair. A vacuum cleaner with high suction power will ensure thorough cleaning and leave your floors spotless.

Understanding Suction Power

Suction power is usually measured in air watts or cubic feet per minute (CFM). Air watts measure the vacuum cleaner’s overall power, while CFM measures the volume of airflow produced. Look for a vacuum cleaner with high air watts or CFM ratings for optimal suction power.

Consideration for Different Floor Types

Different flooring surfaces require different levels of suction power. For carpets, a vacuum cleaner with a strong suction and a rotating brush roll can effectively remove embedded dirt and dust. On the other hand, hard floors may require a vacuum cleaner with adjustable suction settings to prevent scattering debris.

Pet Hair and Allergen Removal

If you have pets or suffer from allergies, choosing a vacuum cleaner with specialized features for pet hair and allergen removal is essential. Look for models with powerful suction and effective filtration systems to eliminate pet hair and allergens from your home.

Effectiveness on Carpets and Rugs

Carpets and rugs often trap dust, dirt, and allergens deep within their fibers. When selecting a vacuum cleaner, consider its ability to deep-clean carpets and effectively remove embedded particles.

Performance on Hard Floors

For hard floors, such as laminate, hardwood, or tile, you’ll want a vacuum cleaner that can efficiently pick up debris without scratching the surface. Look for models with soft brushes or attachments specifically designed for hard floors.

When assessing the suction power of a vacuum cleaner, consider your specific cleaning needs, the types of surfaces in your home, and any unique challenges like pet hair or allergies.

Bagged vs Bagless Vacuum Cleaners

The next factor to consider is whether you prefer a bagged or bagless vacuum cleaner. Both options have their advantages and disadvantages, so understanding the pros and cons will help you make an informed decision.

Pros and Cons of Bagged Vacuum Cleaners

Bagged vacuum cleaners use disposable bags to collect dirt and debris. Here are some pros and cons to consider:

Pros

- Hygienic disposal: Bagged vacuum cleaners can offer a more hygienic disposal process since you can simply remove the bag and throw it away without any contact with the dirt or allergens.

- Less mess during emptying: Bagged vacuum cleaners minimize the chances of debris spilling out during the emptying process.

- Higher dust capacity: Bagged models often have larger dust capacities, allowing you to clean for longer periods without needing to empty the bag.

Cons

- Ongoing cost: Bagged vacuum cleaners require regular replacement of the bags, which can add to the overall cost.

- Reduced suction as bag fills: As the bag fills up, the suction power may decrease, requiring you to replace the bag more frequently.

- Limited visibility: Since the dirt is contained within the bag, it may be challenging to see how full the bag is without opening the vacuum cleaner.

Pros and Cons of Bagless Vacuum Cleaners

Bagless vacuum cleaners use dust containers or canisters to collect dirt and debris. Here are some pros and cons to consider:

Pros

- Cost-effective in the long run: Bagless vacuum cleaners eliminate the need to purchase replacement bags, reducing ongoing costs.

- Ease of emptying: With bagless models, you can easily remove the dust container, empty it, and return it to the vacuum cleaner.

- Visible dust capacity: Bagless models often come with transparent canisters, allowing you to see when it’s time to empty the container.

Cons

- Messy emptying process: Emptying a bagless vacuum cleaner can be messy, especially if you suffer from allergies or sensitivity to dust.

- Regular filter cleaning: Most bagless models require regular cleaning of filters to maintain optimal performance and prevent clogging.

- Smaller dust capacity: Bagless vacuum cleaners typically have smaller dust capacities compared to their bagged counterparts, meaning you may need to empty them more frequently.

Consider your personal preference and cleaning habits when deciding between bagged and bagless vacuum cleaners.

best cordless vacuum cleaner malaysia

Filtration Systems

A vacuum cleaner’s filtration system plays a crucial role in maintaining indoor air quality and trapping allergens. There are several types of filtration systems to consider when choosing a vacuum cleaner.

High-Efficiency Particulate Air (HEPA) Filters

HEPA filters are considered the gold standard in filtration systems. They can capture up to 99.97% of particles as small as 0.3 microns, including dust mites, pollen, pet dander, and other allergens. If you or your family members suffer from allergies or asthma, choosing a vacuum cleaner with a HEPA filter is highly recommended.

Cyclonic Filtration

Cyclonic filtration systems use centrifugal force to separate dirt and debris from the airflow. They are effective in preventing clogs and maintaining suction power. While not as efficient as HEPA filters in capturing fine particles, cyclonic filtration systems can still provide good overall filtration.

Water Filtration

Water filtration is an innovative filtration system that uses water to capture dust and allergens. The dirt and debris are trapped in the water, preventing them from being released back into the air. Vacuum cleaners with water filtration can be an excellent choice for individuals with severe allergies or asthma.

Consider the filtration system of a vacuum cleaner to ensure it effectively captures dust, allergens, and other particles, providing cleaner air during the cleaning process.

Size and Weight Considerations

The size and weight of a vacuum cleaner can greatly impact its maneuverability and usability. Consider the following factors when evaluating the size and weight of a vacuum cleaner:

Maneuverability and Storage

A lightweight and compact vacuum cleaner is easier to maneuver around furniture, corners, and tight spaces. If you have multiple levels in your home or struggle with mobility, a lightweight vacuum cleaner will make it easier to clean hard-to-reach areas and carry between floors. Additionally, consider the storage space available in your home and choose a vacuum cleaner that can be stored conveniently.

Stair and Upholstery Cleaning

If you have stairs or frequently need to clean upholstery, consider a vacuum cleaner with specific features for these tasks. Look for models with detachable handheld units or specialized attachments for stair cleaning and removing pet hair from upholstery.

User Mobility

If you or someone in your household has limited mobility or strength, a lightweight vacuum cleaner with ergonomic handles and maneuverable swivel heads will be more user-friendly. Ensure the vacuum cleaner is easy to push, pull, and steer to prevent fatigue or strain during use.

By considering the size and weight of a vacuum cleaner, you can choose one that is comfortable to handle and suits your individual cleaning needs.

cordless vacuum cleaner malaysia

Noise Level

The noise level of a vacuum cleaner can greatly affect your cleaning experience, especially if you have young children, pets, or live in an apartment building. Here are some factors to consider when evaluating the noise level of a vacuum cleaner:

Decibel Ratings

Decibel (dB) ratings indicate the noise level produced by a vacuum cleaner. Lower dB ratings indicate quieter operation, while higher dB ratings suggest a louder machine. Look for vacuum cleaners with lower dB ratings if noise is a concern in your household.

Noise Reduction Technology

Some vacuum cleaners come equipped with noise reduction technology to minimize the sound they produce. These models often have sound-dampening insulation or special design features that reduce vibrations and noise levels during operation.

Consideration for Different Environments

If you live in an apartment or have neighbors in close proximity, consider choosing a vacuum cleaner with a quieter operation to avoid disturbing others. Additionally, if you have babies or young children who are sensitive to loud noises, a quieter vacuum cleaner will make cleaning sessions more enjoyable for them.

Prioritize your comfort and the peace of your household when selecting a vacuum cleaner with a noise level that suits your needs.

Corded vs Cordless Vacuum Cleaners

The choice between a corded or cordless vacuum cleaner depends on your cleaning preferences and lifestyle. Consider the following factors when deciding between the two options:

Convenience and Portability

Cordless vacuum cleaners offer unmatched convenience and portability. They allow you to move freely without the restrictions of a power cord, making it easier to clean multiple rooms or hard-to-reach areas. Cordless vacuum cleaners are ideal for quick clean-ups or if you have limited power outlets in your home.

On the other hand, corded vacuum cleaners offer continuous power without the need to recharge batteries. They are typically more powerful and suitable for deep cleaning larger areas. Corded models are well-suited for individuals who prefer longer cleaning sessions and don’t want to worry about battery life.

Battery Life and Charging Time

If you opt for a cordless vacuum cleaner, it’s essential to consider the battery life and charging time. Look for models with longer battery life, especially if you have a larger home or multiple floors to clean. Additionally, consider the charging time required to fully recharge the batteries, as some models may take several hours to reach a full charge.

Suction Power Comparison

Corded vacuum cleaners generally offer more suction power compared to cordless models. If you have dense carpets or heavily soiled areas that require deep cleaning, a corded vacuum cleaner may provide the necessary power. Cordless models, while convenient, may not have the same level of suction and may struggle with tougher cleaning tasks.

Consider your cleaning routine, the size of your home, and the specific cleaning challenges you face when deciding between a corded or cordless vacuum cleaner.

Accessories and Attachments

The availability and quality of accessories and attachments can greatly enhance the functionality and versatility of a vacuum cleaner. Here are some key considerations when evaluating the accessories and attachments:

Common Accessories

Most vacuum cleaners come with standard accessories, such as crevice tools, dusting brushes, and upholstery attachments. These attachments are handy for cleaning hard-to-reach areas, dusting furniture and shelves, and removing pet hair from upholstery.

Specialized Attachments

Consider any specific cleaning tasks you frequently encounter and choose a vacuum cleaner that offers specialized attachments to address those needs. For example, if you have a lot of pet hair, look for a model with a pet brush attachment. If you have delicate surfaces like wood or glass, consider a vacuum cleaner with a soft brush attachment to prevent scratches.

Ease of Attachment and Removal

Evaluate how easy it is to attach and remove the accessories. A vacuum cleaner with a quick-release feature will make it more convenient to switch between attachments and adapt to different cleaning tasks.

The availability and quality of accessories and attachments can significantly enhance the versatility and effectiveness of a vacuum cleaner. Consider your specific cleaning needs and choose a model that comes with the accessories that will be most useful to you.

Warranty and Customer Support

The warranty and customer support provided by the vacuum cleaner manufacturer can give you peace of mind and assurance of quality. Here are some factors to consider:

Warranty Coverage

Check the warranty coverage offered by the manufacturer. Look for a vacuum cleaner that comes with at least a one-year warranty, as this ensures that any defects or malfunctions will be taken care of within a reasonable timeframe.

Customer Support

Research the reputation of the manufacturer’s customer support. Read customer reviews and check if there are any common complaints regarding the manufacturer’s responsiveness and willingness to assist with troubleshooting or repairs.

Return Policies

Understand the return policies and procedures in case you encounter any issues with the vacuum cleaner. Ensure that the manufacturer or retailer has a hassle-free return process in the rare event that you are unsatisfied with your purchase.

Choosing a vacuum cleaner from a reputable manufacturer with a solid warranty and reliable customer support will provide you with peace of mind and ensure a positive ownership experience.

Price Range

The last factor to consider before buying a vacuum cleaner is the price range that fits within your budget. Vacuum cleaners are available at various price points, so it’s essential to determine how much you are willing to invest.

Budget Range

Set a realistic budget that suits your cleaning needs and financial situation. Consider the long-term value and performance of the vacuum cleaner rather than just the initial price. It’s worth investing in a quality vacuum cleaner that will serve you well for years to come.

Value for Money

When assessing a vacuum cleaner’s value for money, consider its features, performance, durability, and warranty coverage. A slightly more expensive model with better performance and a longer warranty may provide better value over time compared to a cheaper option.

Long-Term Cost Analysis

Apart from the initial purchase price, consider any ongoing costs associated with the vacuum cleaner. For example, bagged models require regular bag replacements, while bagless models may require filter replacements. Factor in these costs to get a complete picture of the long-term affordability of a vacuum cleaner.

By determining your budget range, evaluating the value for money, and considering the long-term costs, you can make a wise investment in a vacuum cleaner that aligns with your financial situation.

In conclusion, buying a vacuum cleaner requires careful consideration of various factors to ensure you make the right choice. Evaluate the type of vacuum cleaner that suits your needs, assess the suction power and performance, decide between bagged or bagless options, consider the filtration system, size and weight, noise level, corded or cordless functionality, available accessories and attachments, warranty and customer support, and price range. By taking these factors into account, you’ll be able to find the perfect vacuum cleaner that meets your cleaning requirements and helps maintain a clean and healthy environment in your home or office. Happy vacuuming!